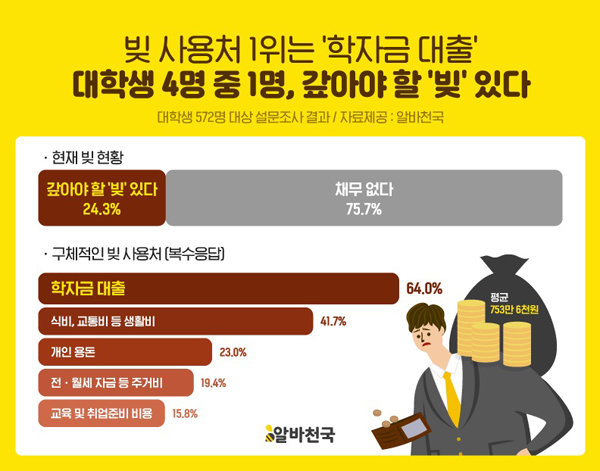

[Editorial] If you need loans for college students, use small pocket money for living expenses

[Editorial] If you need loans for college students, use small pocket money for living expenses

If you are a college student, you will be busy every day receiving pocket money from your parents or working part-time in case of difficulties. However, there is a possibility that you will suddenly need cash even though your income is not constant. If you have to pay your cell phone bill or rent, you may need cash for school expenses or any other problem. However, if you can’t ask your parents or friends and the situation is not good, you can get support using college student loans, small loans, and living expenses loans. However, in the face of economic difficulties, loans are often carried out without looking into them in an urgent manner, but the amount and interest received vary depending on the loan product or company, so a careful check process is needed.

However, it is not easy to carefully check and compare these companies while studying and even working part-time while attending school. If you need cash right away, but are at a loss because there is no way to get it, or if you think it is difficult to approve the loan itself due to lack of regular income, please consult with Loan More.In Loanmore, only officially registered companies can apply for counseling, and it is convenient to compare and check various information at once on the site. You may be worried that your credit rating will fall when you go through the loan screening, but you don’t have to worry because there are no procedures such as membership.

In addition, the conditions and credit ratings presented by each company may be different, so you may have to go through a review to see if they meet them, but it is generally less difficult, so it can be carried out without any burden.

But the most important thing is to see if I can pay you back. There are various products such as college student loans, emergency loans, and small loans, so you can choose what I want, what I need, and what suits my conditions. If you make a wrong choice, you can immediately reduce the burden at first, but it may be difficult to repay later.Therefore, I think you need to look into it as carefully as possible to finish the current burden smoothly and continue your daily life by repaying it without any burden.

If you search for a company on Lonemore and proceed with the consultation, you can check more details, so please think carefully before deciding. Even if your credit rating is not good or you already have a loan, it is not impossible at all, so you can proceed according to the current situation, and you can also save time by conducting counseling on mobile without visiting.

If you explain your current situation through counseling and make a choice after receiving counseling, it will be more helpful than suffering alone. Consultation is conducted according to individual differences and does not affect your credit rating, so please get help.

Economic difficulties and crises come to everyone. However, how and how to solve this crisis is more important, so I think it would be better to reduce the burden and solve it one by one. It would be great if things could improve naturally, but this doesn’t happen easily, so try consulting at Lonemore.Previous Image Next ImagePrevious Image Next ImagePrevious Image Next Image